A flexible force multiplier

With capital becoming increasingly commoditized, the ability to create operational value is the most sustainable path of differentiation in private equity. Yet very few firms have the ability to support the cost structure of a full-fledged, best-in-class internal portfolio operations function.

The solution? Blair Hall Partners.

Deep operating experience deployed flexibly for firms without an in-house portfolio operations group or as an extension of an existing team that lacks specific domain expertise.

A clear case for change

The paths to value creation in private equity have shifted and operational value creation is paramount

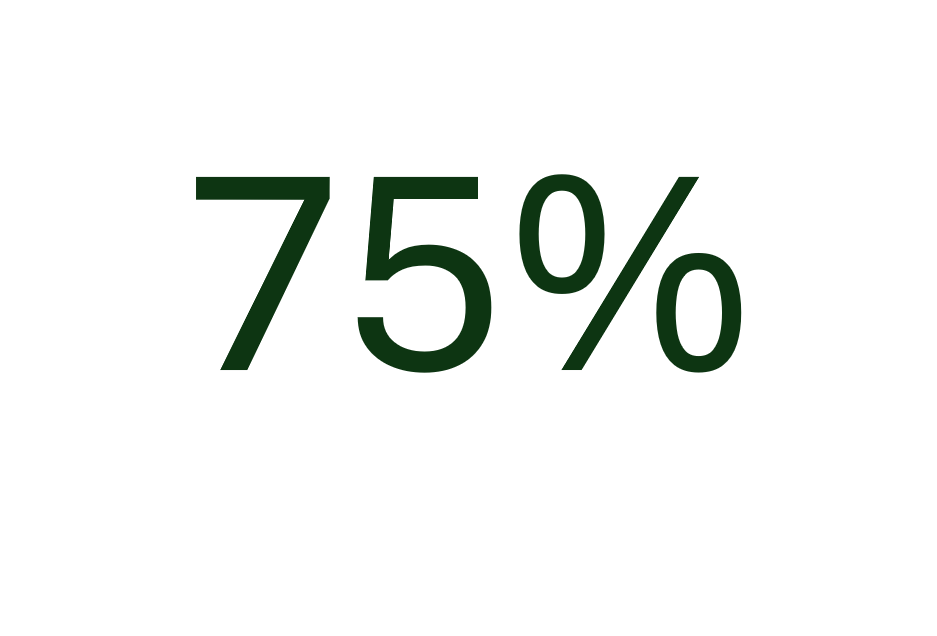

OPS > FINANCIAL ENGINEERING

PE leaders’ view on percentage of firm efforts that should go towards operational value creation versus financial engineering (25%)

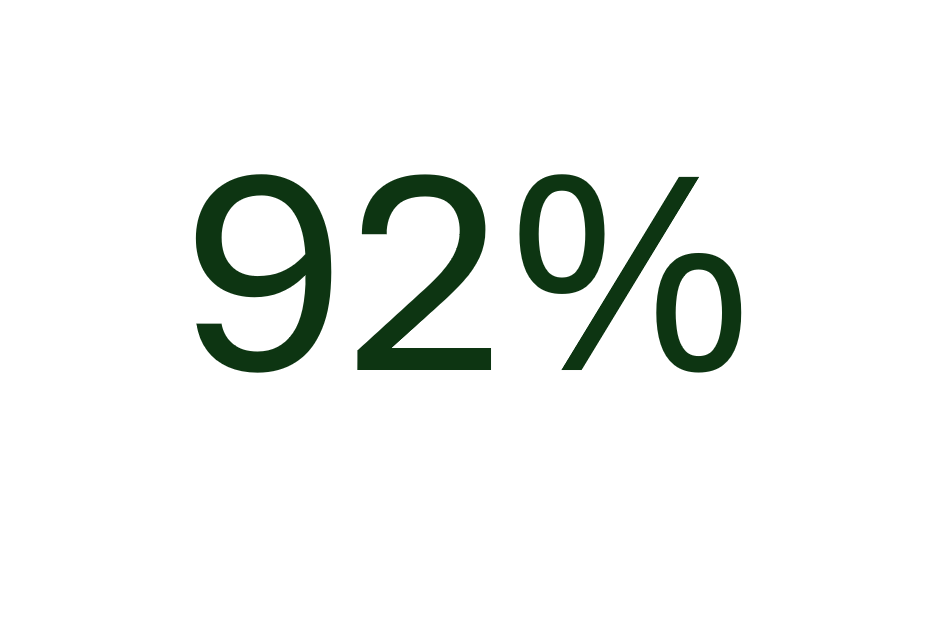

RELATIVELY IMMATURE

Share of mid-sized companies that have room for operational improvement (i.e., have not yet reached ‘operational maturity’)

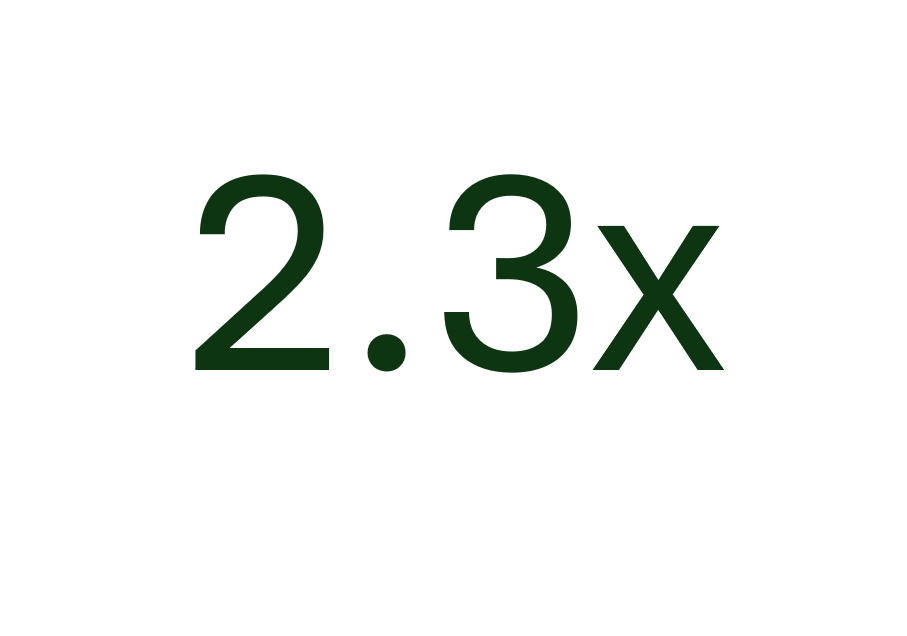

MARGIN SUPERIORITY

Higher margins for companies reaching the highest level of operational maturity

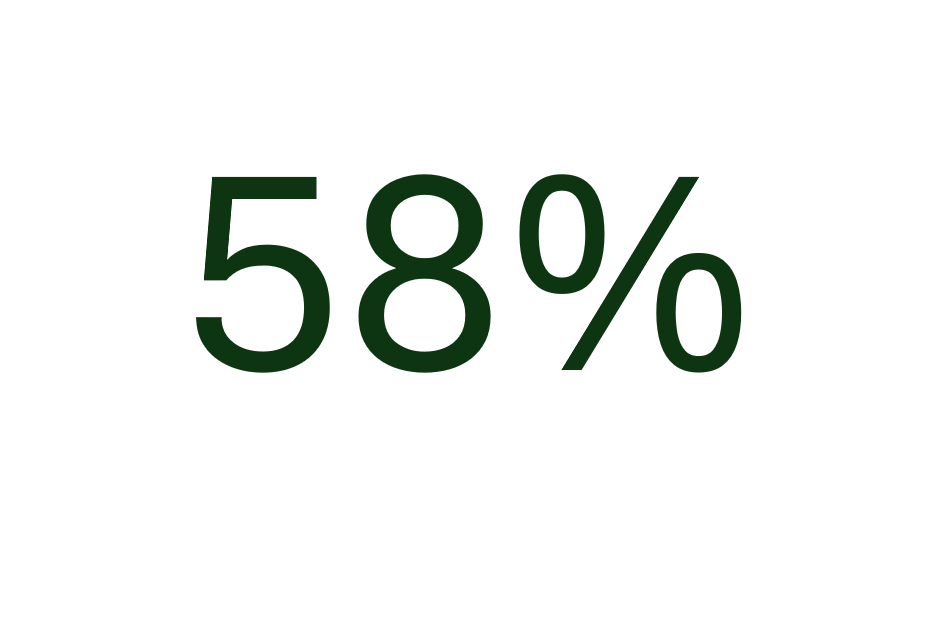

A RECOGNIZED OPPORTUNITY

Percentage of PE leaders that rank broken operating models and an inability to scale operations among their top three challenges to value creation

How we support your organization

While every firm is unique and priorities evolve in real time, Blair Hall Partners consistently engages with private equity firms (buyout, growth equity, and VC) in five core areas.

value creation planning

Identification of priority strategic initiatives, growth opportunities, and operational improvements along with definition of KPIs and tracking mechanisms to guide company execution.

operational improvement

Deep-dive into current company operations yields roadmap of sized and prioritized opportunities to enhance business performance.

commercial excellence

Acceleration of profitable and incremental growth through key commercial levers spanning pricing optimization, marketing strategy/execution, salesforce effectiveness, product portfolio management, new market entry, and customer experience enhancement.

digital transformation

Strategic yet financially-disciplined modernization of a company’s data and technology foundation, with a focus on commercially-impactful and customer-facing solutions.

interim / fractional executive

For situations where arms-length guidance doesn’t suffice, we offer an experienced C-level leader with diverse domain expertise that can be deployed flexibly within a portfolio company.

A track record of impact

Proven ability to create measurable value across industry, geography, company size, and functional focus

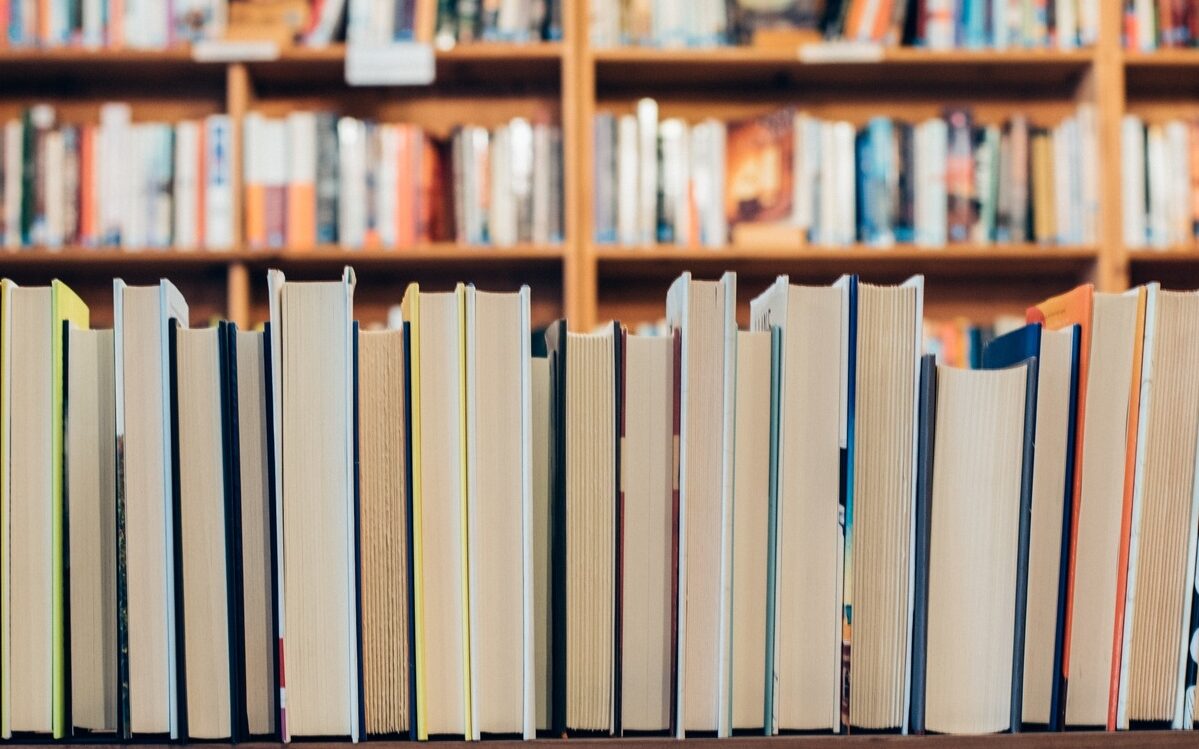

Interim CMO

Middle-market B2B library services company

Built 90-day value creation plan across book and media businesses

Led cross-functional team in scoping and executing initiatives focused on ramping momentum before key selling season

Guided teams to reposition core brand, launch an entirely new pricing and loyalty strategy, negotiate access to value-add content from a top publisher, and revamp tradeshow strategy

Result: trend-bend from revenue decline to YoY growth and 6% beat versus budget

Chief Commercial Officer

Distressed middle-market wine company

Owned $170M commercial P&L across wholesale and direct-to-consumer channels

Exceeded revenue budget by 25% and delivered 73% YoY reduction in operating expenses

Owned 13-week commercial cash flow forecasting in partnership with restructuring advisor and investment banking partner

Led 155-person cross-functional organization through Chapter 11

Interim Transformation Lead

Top 20 global retailer

Responsible for catalyzing turnaround of multi-billion dollar-pound division

Operationalized transformation strategy and developed new operating model in priority categories

Led cross-functional working group and launched pilot stores across the UK

Accelerated early omnichannel strategy development and unified value proposition across stores, website and mobile

Growth & GTM Advisor

Leading warehousing and fulfillment provider

Engaged by direct lending arm of a private equity firm

Conducted rapid market assessment and identified go-forward priorities across service lines and customer segments

Analyzed prospecting pipeline and pressure tested financial projections

Sized customer acquisition and pricing ‘go get’ required to deliver against budget

Built an actionable go-to-market roadmap focused on needle-moving initiatives

Head of Media Platforms & Marketing AI

$27B food and beverage company

VP with board-level mandate to launch company’s first ‘personalization at scale’ offering

Scaled consumer profile infrastructure and piloted use of machine learning to precisely target and engage consumers

Personalized website and launched loyalty program pilot (+208% spend vs. control)

Owned company media properties including a top food website and a print magazine with over 1 million paid subscribers

Opex Reduction Advisor

Middle-market food and beverage company

Built granular spend cube covering tens of millions of dollars of spend

Engaged cross-functional stakeholders in a zero-based revamp of spend based on return profile and impact on competitive differentiation

Rationalized thousands of vendors/suppliers to consolidate spend and secure improved pricing and terms

Aggressively moved to cut superfluous spend and implement changes in a matter of weeks (not months), leading to millions in projected savings

Testimonials

A consistent theme of strategic thinking, decisive leadership, and collaborative partnership…

Seth Kaufman

VWE CEO and former President & CEO at Moët Hennessy North America

“Ryan is a phenomenal change leader, data-driven decision-maker and champion of creating value for businesses in an agile, refreshing way that challenges the status quo. His depth and breadth of experiences contribute to his ability to bring forward novel solutions to complex problems. I look forward to seeing the impact he has across multiple businesses and industries, leading this new endeavor.”

Former Head of Transformation

Tesco PLC

“I worked alongside Ryan on a huge transformation project at Tesco. There wasn’t a part of the business that was not overhauled. We worked on everything from omnichannel strategy to merchandising and sourcing…we even spent days in a dusty 50,000 sq ft warehouse building it all out. Ryan’s innovation, attention to detail and ability to synthesize vast amounts of data into a precise strategy was extremely helpful. He remains to this day a highly trusted advisor.”

Former VP & Group Leader

Kraft Heinz

“Ryan has a unique ability to drive higher order strategic thinking while also delivering on tactical execution to unlock growth. He is adaptable to a variety of business dynamics and the leadership he brings to any situation is unmatched. He is able to marry business thought leadership, financial acumen, creative thinking, and an operational ability to execute the plan. Ryan brings credibility and authority with Board members while also working closely alongside junior team members.”

Our experience is your asset

founder & managing partner

Ryan Watson

Founder Ryan Watson has a unique twenty year track record of value creation in some of the most demanding corporate environments, ranging from Amazon, Kraft Heinz, Goldman Sachs and Boston Consulting Group to VC-backed growth-stage disruptors and distressed middle market companies. He combines the strategic horsepower of a BCG Partner, the commercial mindset of a P&L owner, and the deep domain expertise of an executive who has led organizations of 150+ across multiple functions.

Importantly, Ryan has supported PE-backed companies in interim C-level roles, has executed multiple quick-turn diligence projects as a consultant, and has held C-level operating leadership roles at several PE/VC-backed companies.

EXTENDED DOMAIN EXPERTISE

Industries, Geos & Functions

Needs evolve in real-time and Blair Hall Partners is able to nimbly match this evolution by deploying a tailored mix of seasoned leaders.

Recognizing the importance of deep experience across geographies, industries and functions, we have built a group of established experts that complement our core to ensure we can meet the needs of our clients. No more need to shop around and cobble together a disjointed group of partners…Blair Hall Partners is purpose-built to be the only change agent your organization needs.

Bespoke partnership structure

A range of flexible options exist to meet the unique needs of your firm

Project-based

Supported by detailed joint scoping work in advance, these project-based engagements focus on discrete initiatives designed to be completed in a fixed period of time.

Retainer

Leading to always-on capacity that can be utilized as and when needed, this model allows for opportunistic partnership on key strategic, operational, and financial priorities